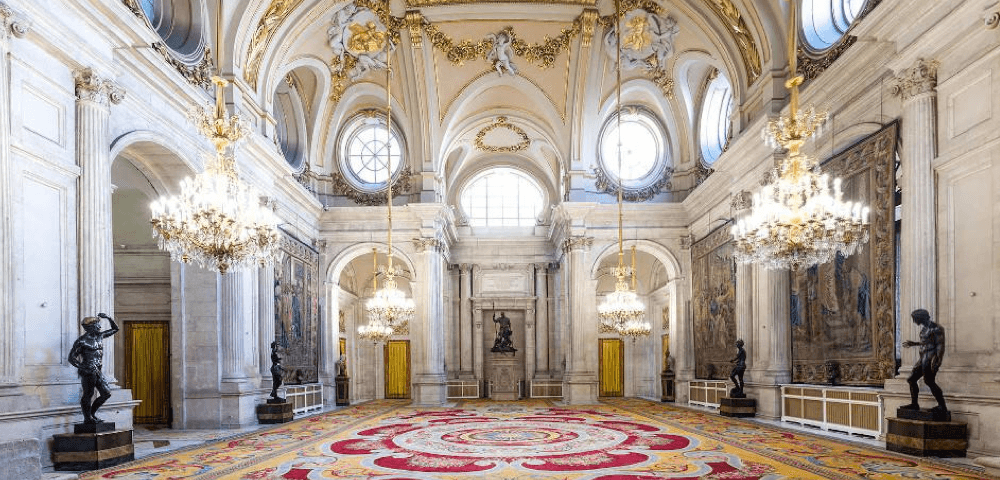

History and Heritage

RAMG originates from the Spanish royal family's long-term guardianship of wealth. From early land and mineral resources to modern energy, infrastructure, cultural tourism, and financial assets, the group has always represented the royal family in promoting wealth continuity and economic development.